Vision Statement

Your member owned financial partner providing a safe, trusted and innovative environment offering financial security to current and future generations.

Mission Statement

To create a partnership between members and their credit union for mutual financial success.

We’ve come a long way since 1939. Here’s what we’ve been up to:

2020s

2023

We kickstarted the year by welcoming Brandon and Sondra as Member Services Representatives to help members out at the teller counter, over the phone with daily banking needs and member support. Additionally, Nimishca, our Marketing Intern, joined us to contribute to our marketing team.

In June, we bid farewell to Linda "The Legend" after 34 years of service. Before she embarked on the rest of golf season, we welcomed members in branch for a celebration filled with food, drinks and warm toasts. With Linda's departure, Sarah took on the role of Administration Officer, assuming some of Linda's responsibilities, and Suzanne was promoted to Director of Operations.

With a recent increase in the number of frauds, we made it our consistent goal to help our members protect themselves. We established a monthly eblast focusing on Fraud Awareness, covering a multitude of scams that keep our members updated on the latest trending frauds. These emails showcase the red flags to look for and provides advice on how to safeguard yourself. Information on recurring scams can also be found on our social media pages. Additionally, our Fraud Awareness webpage is always available, offering up-to-date information on prevalent scams and ways to protect yourself.

Lastly we want to highlight our collaborations with our community. The donations between OCCU and our extremely generous membership have factored into the growth and success of many programs and charities, allowed the opportunity to connect with wonderful people, and support those in need.

Lastly we want to highlight our collaborations with our community. The donations between OCCU and our extremely generous membership have factored into the growth and success of many programs and charities, allowed the opportunity to connect with wonderful people, and support those in need.

2022

After the “rollercoaster ride” of managing the health and safety of our employees and members while providing services to our members to meet their financial needs during the pandemic were back on track in 2022 with renewed optimism!

A refresh of our Online Banking and Mobile Apps was launched in 2022 that includes a new simplified user interface, an improved look and feel, enhanced navigation and some highly requested features such as:

- Business tax filing and remittance

- CRA direct deposit registration for individuals and businesses

- Online cheque ordering and stop cheque requests

- Enhanced security alerts via email and/or text message

And don’t forget Live Chat was launched to allow members to ask questions and get a quick response from one of our frontline staff members!! Great way to stay connected.

In June, we wished Jackie a bittersweet goodbye as we celebrated her retirement after 24 years of service to the Credit Union. With Jackie on a permanent “coffee break” we announced the promotion of Samantha to fill her role. Let’s not forget Sarah, you can find her in an office helping members with their lending needs.

We welcomed Patricia and William to our team who assist members at the teller counter, over the phone with daily banking needs and IT support along with Brady our part time student.

2021 - Member-Friendly Technology

With so many members opting to bank online during the pandemic, Oshawa Community launched a new member-friendly website, Mobile Online Banking App and Internet Banking Platform. Designed by Oshawa Community staff and fine-tuned based on the recommendations of our members ranging in age, financial know-how and tech skills, our goal was to create a member-friendly website:

-

easy to navigate

-

informative and educational

-

written in clear and concise language

These new and improved online services are vital to attract the next generation of young, tech savvy members and to provide our membership with innovative technology and an overall better and safer online banking experience.

2020 - Operational Agility

While the COVID-19 pandemic greatly affected our regular operations, Oshawa Community practiced “Operational Agility”. By working as a team, Oshawa Community thought outside of the box to find solutions to service members with little disruption including guiding them through our other “Ways to Bank”:

-

Online banking through our member-friendly website

-

Mobile Online Banking App

-

Exchange Network of ATMs

Members could also call their favourite employee working in-branch or at home to answer their questions, process transactions and provide technical support for our online services.

Office Transformation

In 2020, Oshawa Community took the opportunity to modernize the branch with a much needed makeover. The soft shades of green and blue emulate our branding and provide a sense of calm to staff and members (which is especially important now). We couldn’t be happier with the beautiful colours made possible by our talented members Amber & Vincent, small business owners of Precision and Restoration.

TEA Time at the Credit Union

It's not what you think: our new “TEA” Centre actually stands for “Technology Education Assistance” Centre, which will allow staff to provide members with hands-on assistance to navigate our online services. The beautiful live-edge wood table has certainly been turning heads! With a variety of mobile devices including an iPad or Android Tablet and an iPhone or Android Phone, members can learn on the same device they use at home. Members are also welcome to bring in their own device.

_______________________________________________________________

2010s

2019 - 80 Years Strong!

On October 17th, 2019, Oshawa Community celebrated 80 years of financial service in Oshawa and our surrounding community. The staff hosted a soiree at the branch to commemorate this special milestone. Mayor Dan Carter was in attendance along with past and current directors, employees, and most importantly, our loyal members. Those in attendance reminisced about the early days and had the opportunity to learn more about our history by perusing vintage memorabilia, old staff photos, newspaper clippings and advertisements. Some guests including Mayor Carter, CEO John Remillard and long-time member John Dick shared some personal stories with the guests about the impact the Credit Union has had on themselves and the community.

We also decided to document our history from our humble beginnings to the successful cooperative we are today.

New LED sign complements new look

The Board of Directors approved the installation of two LED pylon signs on either side of the branch. So whether you’re driving east or west past the branch, you will see updates of our latest promotions, rates, staff birthdays, and local events.

2019 - Deposit Anywhere!

Oshawa Community introduces the Mobile Remote Deposit Capture feature allowing members to truly bank anywhere. This feature enables members to deposit a cheque to their account by taking a picture with their smartphone on our Mobile Online Banking App.

2015 - New Faces!

The next five years were bittersweet as we reluctantly said goodbye to five long term employees.

Diane retired in 2015, followed by Margaret and Karen in 2017, Ann in 2018 and Teresa in 2020. While it was sad to see them go, we were happy to see them start the next chapter of their lives.

As a result, the Credit Union brought in some new faces. Sarah and Jakob started as tellers in 2015. Sarah quickly moved to reception where her sunny personality would shine the brightest and Jakob, was the perfect candidate with his expertise in IT, soon advanced as our IT Manager when Karen retired.

In 2018, Samantha and Amy were hired only a few short months apart from each other and are holding down the front line with the support of the tellers that came before them, only “a shout across the office” away.

Suzanne joined the frontline later that year and began assisting the lending department as she had a wealth of experience from her previous positions. Shortly after the pandemic hit, we were sent home to work and our dear Teresa decided this would be a good transition to retirement. Suzanne, who had been training with Teresa in lending, was promoted to the Retail Credit Manager position.

While some members may have wondered about the employee transitions, the members soon adapted and the new employees became part of the Credit Union family. Thanks to the senior employees who have done an amazing job passing on their knowledge so that the next generation of employees can provide the same outstanding service our members have come to expect, and deserve.

2010 - New Decade, New Look!

This was the beginning of Oshawa Community’s transformation! New service counters were installed and new offices were built on the south side of the building. The aesthetics of the outside were updated as well, including the installation of awnings and the new Oshawa Community sign with our logo.

_______________________________________________________________

2000s

2008 - Introduction of the Cash Recycling Unit

The introduction of the Cash Recycling Unit (CRU), which enables staff to deposit, withdraw, exchange, count and even detect counterfeit bills was a game changer. Because the CRU counts the bills coming in and going out, the frontline staff is better able to focus on servicing the member, rather than documenting every bill that comes in and goes out. The CRU creates a paper trail which is extremely helpful for auditing purposes and balancing discrepancies. Furthermore, the CRU has multiple security features to safely hold cash eliminating the need for the frontline staff to carry excess cash.

2000 - Internet banking

Internet banking was introduced in the early 2000’s allowing members to conduct many transactions including checking balances, transferring between accounts, paying bills and more recently, Interac e-Transfers, enabling members to securely transfer funds to themselves at other financial institutions, as well as friends, family and business partners.

_______________________________________________________________

1990s

1999 - Chamber of Commerce Corporate Challenge!

The staff of Oshawa Community participated in The Greater Oshawa Chamber of Commerce Corporate Challenge that was held at Durham College back in 1999. The mission of the Chamber is to connect local business leaders and create a network of like-minded individuals to support and nurture the local economy. The Chamber also provides advertising opportunities and hosts networking events like The Corporate Challenge.

The Credit Union staff entered two teams into the competition: Gilligan’s Island and The Village People! (In case you haven’t noticed; we really like to play dress up!) The staff had so much fun putting their costumes together, taking silly pictures and socializing with staff from other local businesses.

1998- Oshawa Community acquired the new banking system, Infonancial, which continues to be used. The coveted passbooks were phased out a short time later as Infonancial had the ability to print receipts and with the introduction of internet banking, members could retrieve their account statements at their convenience. Many in the financial industry moved away from passbooks around this time.

_______________________________________________________________

1980s

1985- Oshawa Community installs its first ATM giving our members access to funds outside banking hours.

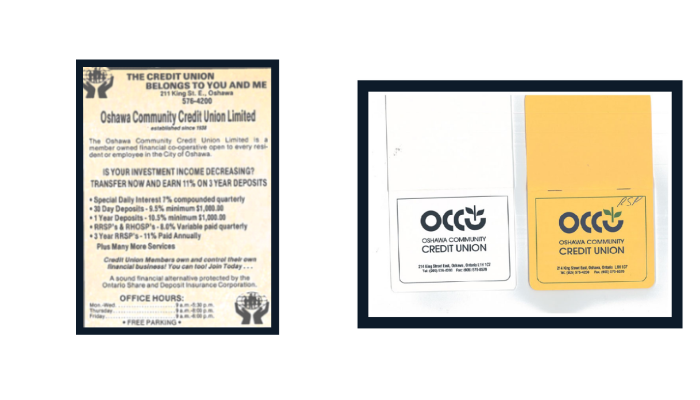

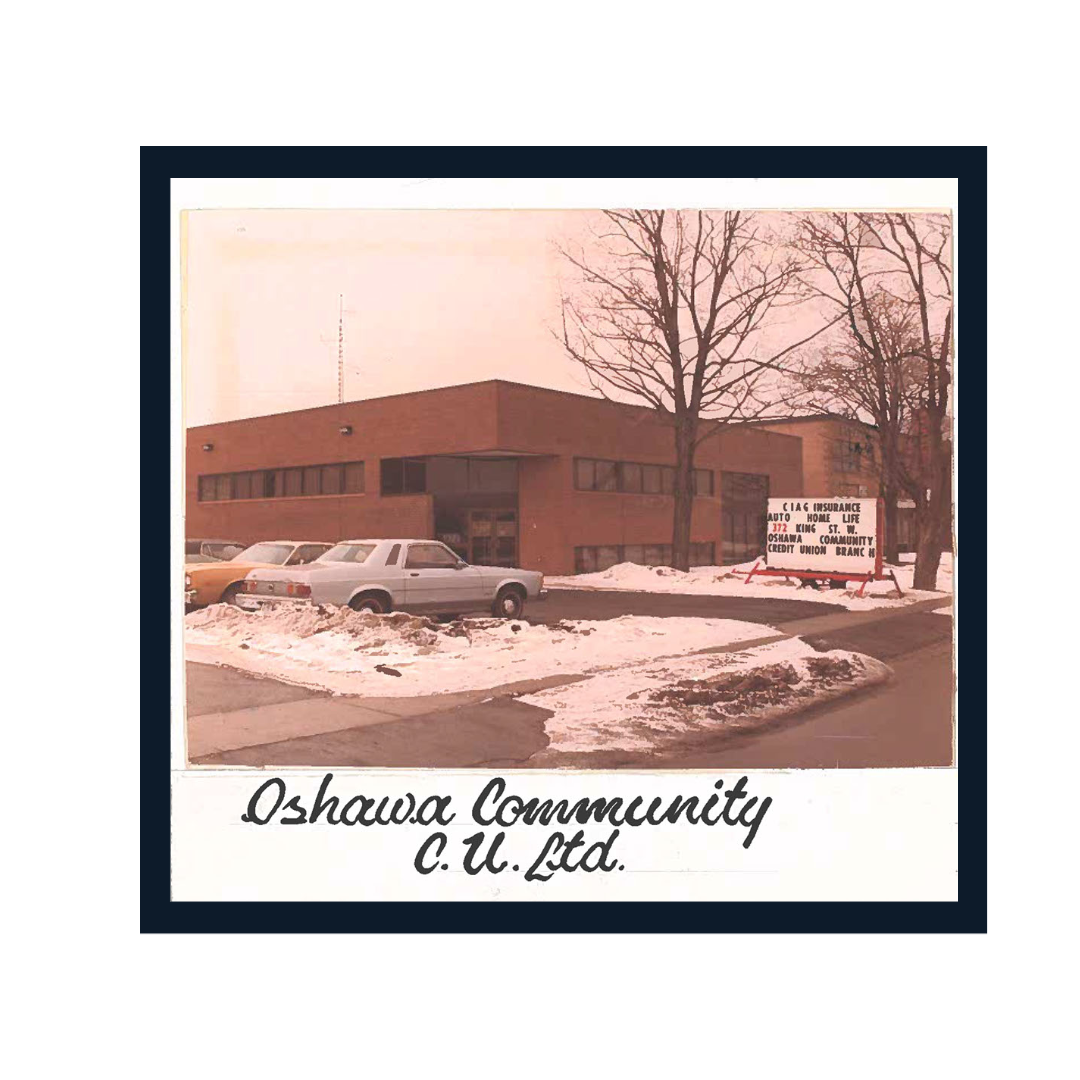

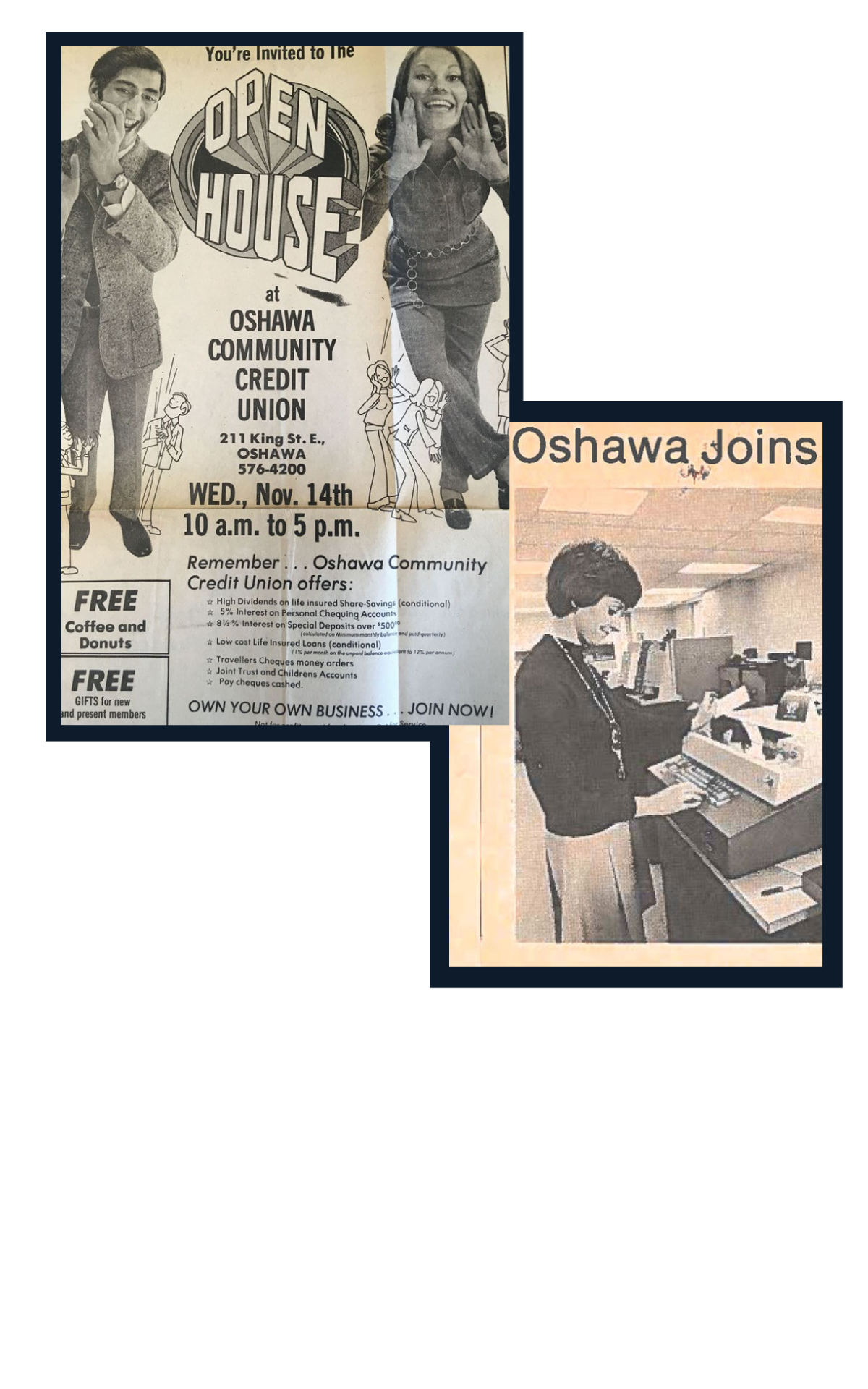

1984- Oshawa Community purchased the former site of King Street Public School to build our existing branch. On April 16th, 1985 the staff moved everything from the old branch across the street and a new era began.

1983- In the early 80’s inflation rates soared and the Bank of Canada, determined to slow the rate of inflation, raised interest rates. Oshawa Community closed the doors of its second location and the two branches merged. Our experienced lending team was able to help members get through these trying times by providing practical advice and the financial support we have come to be known for.

_______________________________________________________________

1970s

1978 - Oshawa Community opened a second, smaller branch in the old Co-Operators building located at 372 King Street West. With one sole employee, this branch was busy!

1977 - The new location at 211 King Street was a huge success. The Credit Union’s membership had grown to 4,155 members and the Credit Union had nearly $7 million dollars in assets. Oshawa Community doubled their staff to facilitate the exceptional success of the new location.

1976 - Oshawa Community was the first credit union in Ontario to roll out a fully automated banking system, introduced by Desjardins in Quebec. Prior to the Desjardins system, everything was done manually.

1972 - The Board of Directors approved to purchase the property at 211 King Street East and the four Oshawa Community employees packed up and moved across the street the following year.

1971 - In the early seventies, Oshawa Community amalgamated with several local credit unions including the Oshawa Municipal Employees Credit Union, the Pedlars and Reynolds Employees Credit Union and the General Printers Credit Union. Furthermore, the membership was now open to anyone living or working in Oshawa.

1970 - Oshawa Central Study Group Credit Union Ltd. Travelled to King Street and changed its name to Oshawa Community Credit Union Ltd. Oshawa Community moved into the basement of the old Sunrow building at 172 King Street East, the first of our four King Street locations.

_______________________________________________________________

1950s

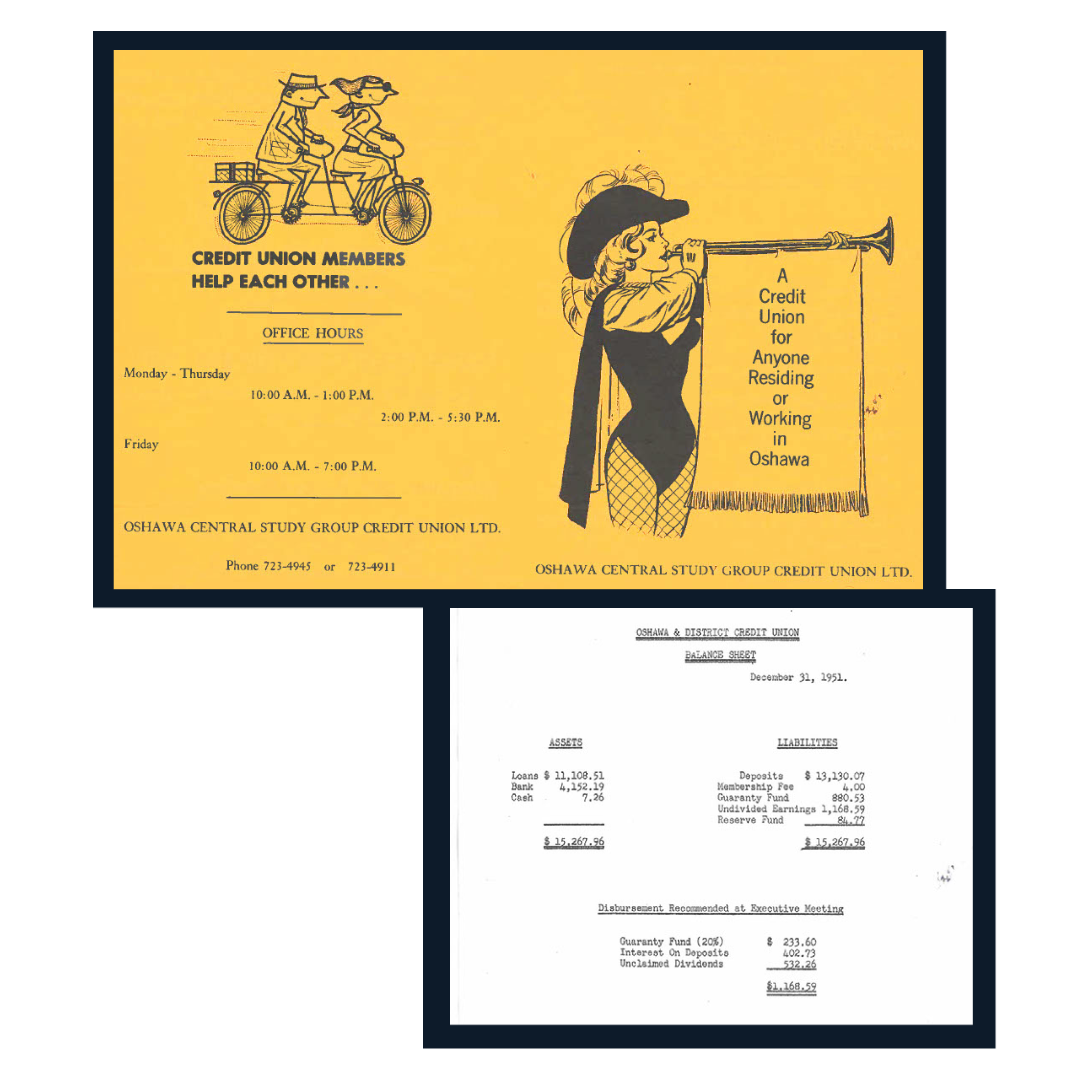

1952 - Oshawa District changed its name to Oshawa Central Study Group Credit Union Ltd. and was now chartered under the provincial government. As a result, there was a minimum membership share requirement of $5 rendering members official owners of the Credit Union.

1951 - Oshawa District had grown to over 140 members with $13,130.07 on deposit, $11,108.51 out in loans and total assets of $15,267.96.

“In those times, if you didn’t have any assets, you couldn’t get a loan. This is one of the reasons credit unions started,” explains Carl Carey who grew up in this era and served on the Credit Union’s Board of Directors for 21 years (1973-1994).

_______________________________________________________________

1939

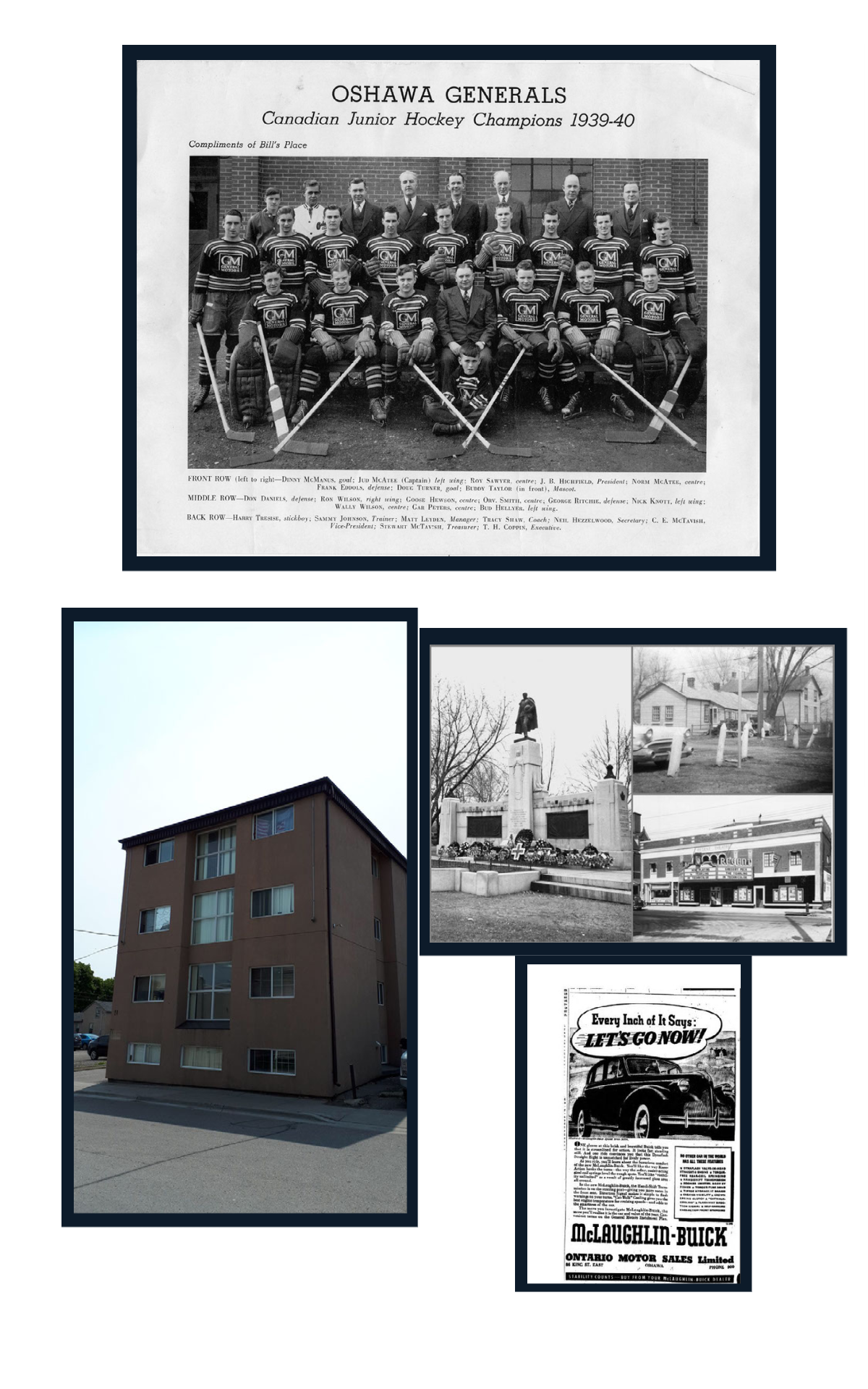

A great year for Oshawa!

“The Oshawa Generals are a team with deep roots in their hometown and with their dedicated fans.”

This quote pulled from the Oshawa Generals website describes Oshawa Community Credit Union Ltd. as well: deep roots in Oshawa and dedicated fans; our loyal members.

We have been a moving fixture in Oshawa since 1939, the same year our beloved hockey team won their first of five Memorial Cups (plus 13 OHL Championships and 184 future NHL players including legends Bobby Orr, Marc Savard, Eric Lindros, and John Tavares - we’re pretty great!)

On October 23rd, 1939, Oshawa District Credit Union (our original name before mergers and re-branding) was established by 19 members with $16 on deposit at the Orange Hall on Bruce Street. The first of several locations over the next 50 years and counting.

Since the Credit Union was not chartered under the provincial government, there was no share requirement, however, there was a 25 cent membership fee. At that time, the little Credit Union welcomed anyone living in Oshawa to join.

“Every Saturday, on my way to the show, my friend and I would walk to the hall and deposit $1 or $2 for my parents. It may not seem like much but that was a lot of money back then. You could buy milk, a loaf of bread and eggs for under a dollar,” recalls long-time member Joyce L.